By accounting for these changes, the statement provides a transparent view of how accumulated profits AI in Accounting have evolved over time. The statement of retained earnings outlines the changes in retained earnings over a specific period. Understanding this statement is vital as it indicates how effectively your business reinvests profits for expansion. It also highlights long-term sustainability, making it essential for stakeholders assessing financial stability.

Subtract Dividends Paid

You can expand on the information listed in your statement of retained earnings if you want, such as par value of the stock, paid-in capital, and total shareholders’ equity. Or, you can keep your statement of retained earnings short, sweet, and to the point. Understanding how retained earnings evolve allows business owners and investors to grasp a company’s financial health and ability to grow or return value to shareholders. This example separates each element that affects the retained earnings, presenting a transparent view to anyone examining the financial health of Sally’s Bakery. The statement shows that the retained earnings have increased after accounting for the net income and dividends paid.

Add net income

- Preparing a statement of retained earnings is essential in demonstrating a company’s commitment to transparency and accountability.

- The statement can be prepared using either Generally Accepted Accounting Principles (GAAP) standards or International Financial Reporting Standards (IFRS).

- Analysts examine this balance to evaluate a company’s growth potential and financial strategy.

- On the dividend front, Widget Inc. opts for a modest share, keeping a part of the earnings close to its chest for reinvestment, a balancing act between shareholder satisfaction and corporate strategy.

- Retained earnings represent a crucial component of a company’s financial health, as they provide the resources needed to support growth and investment in the future.

Retained Earnings balance for the first accounting period will be equal to Net Profit (Not Loss) for that accounting period after deducting of dividends paid out if any. In some cases, retained earnings may be restricted or appropriated for specific purposes. For example, a company may set aside a portion of retained earnings for future expansion projects or to comply with legal requirements.

Dividend Distributions

- Understanding retained earnings is crucial for financial professionals as it provides insight into a company’s financial health and strategic decisions.

- In this example, the ordinary dividends were declared on all shares that are held at 28 February 2022 at $0.35 per share.

- The statement of retained earnings provides crucial insights into a company’s financial health.

- It demonstrates a balanced approach to managing earnings that can be conducive to sustainable growth.

- It begins with the opening balance of retained earnings, which is then adjusted for net income or loss and dividends distributed to shareholders.

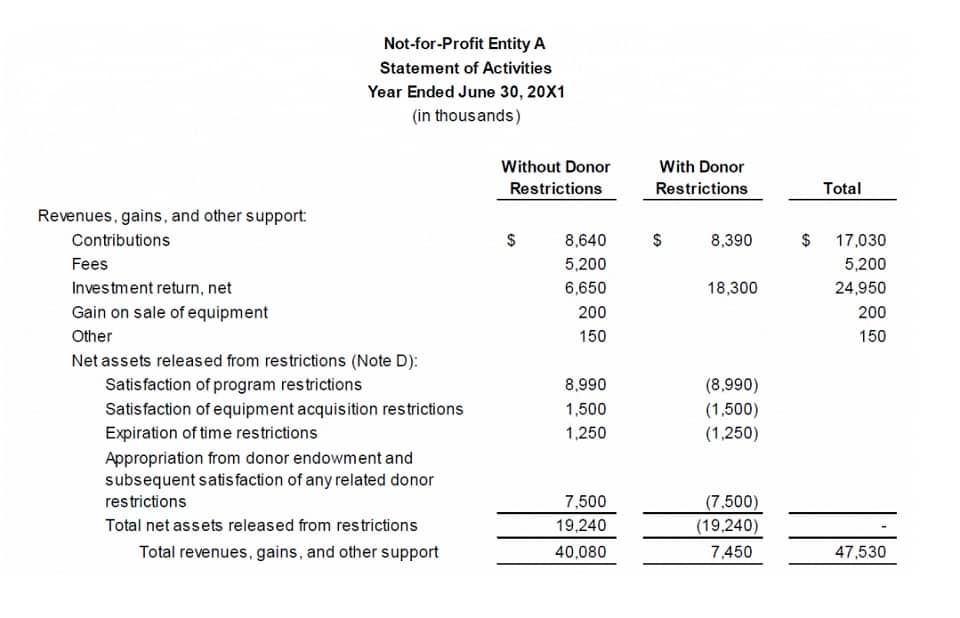

The Statement of Retained Earnings is a crucial financial document that helps in tracking the changes in a company’s accumulated profits over a specific period. It normal balance provides insights into how much profit has been retained in the business after dividends are paid out, offering a clear picture of the company’s financial health and future growth potential. Understanding this statement is essential for stakeholders, including investors and management, as it highlights the company’s ability to reinvest in itself. The statement of retained earnings is a crucial financial document that outlines the changes in a company’s accumulated profits over a specific period. It begins with the opening balance of retained earnings, which is then adjusted for net income or loss and dividends distributed to shareholders. This statement provides insight into how much profit is reinvested in the business versus distributed as dividends.

It’s the residue of past gains, standing ready to fuel future expansions, innovations, or even outlast tough times. ” or not is a significant decision — one that can change the entire narrative of your business’s financial storyline. It’s a narrative you write with care, knowing each chapter influences the future of the company.

How Dividends Impact Retained Earnings

Walking through this example, it’s evident that Zippy Tech is maintaining a healthy cycle of profit reinvestment while retained earnings statement also rewarding its shareholders. It demonstrates a balanced approach to managing earnings that can be conducive to sustainable growth. Remember, it’s not the amounts in themselves that are important; it’s what they represent about the company’s past and future that really matters to investors and stakeholders.